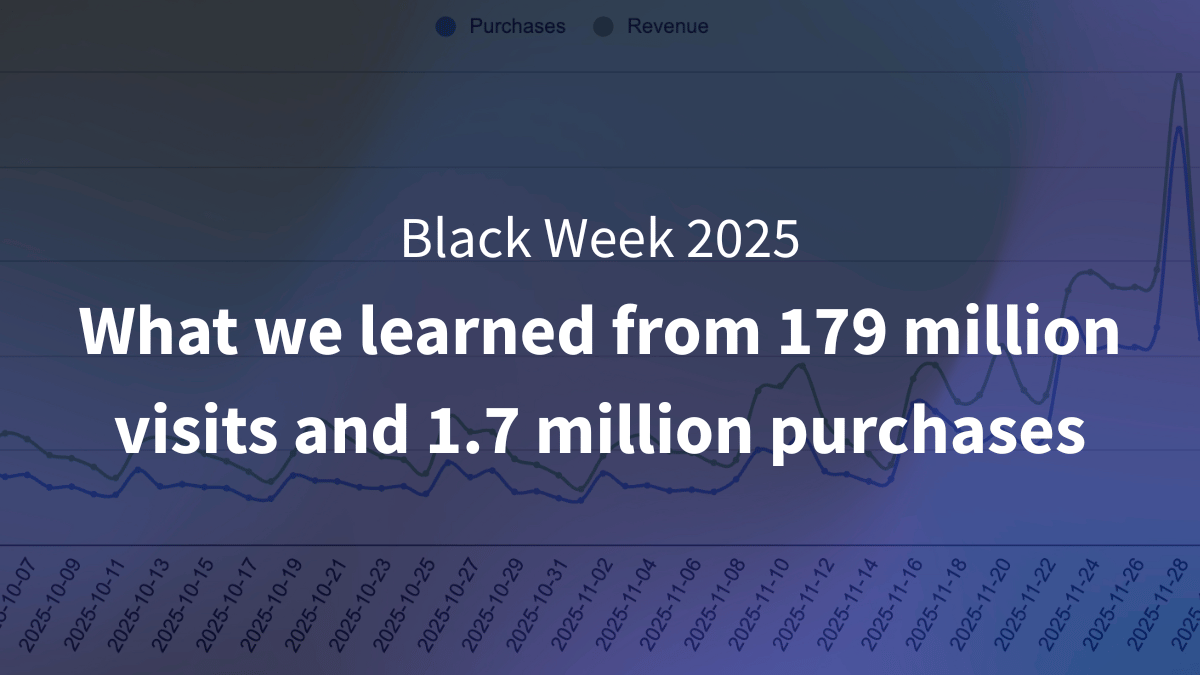

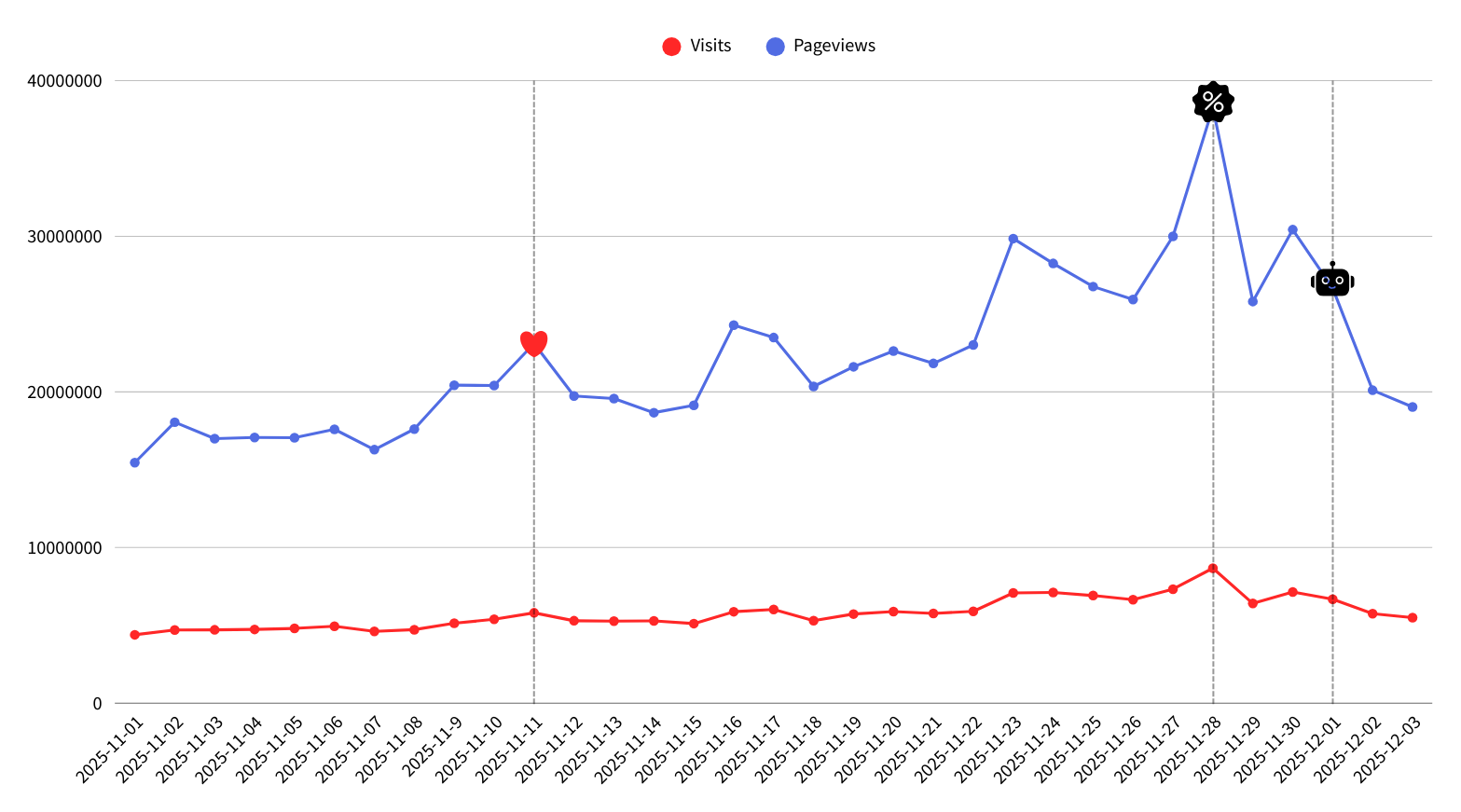

This year’s Black Week was huge. Across all Triggerbee customers we analyzed 179 million visits, 1.7 million purchases, and billions of pageviews during the full period. What stands out is how early the traffic lift begins and how long it lasts. Traffic starts rising two days before Singles Day and stays elevated for almost three and a half weeks.

Here are the patterns, behaviors, and campaign types that consistently delivered results across hundreds of e-commerce sites:

Buying behavior during Black Week 2025

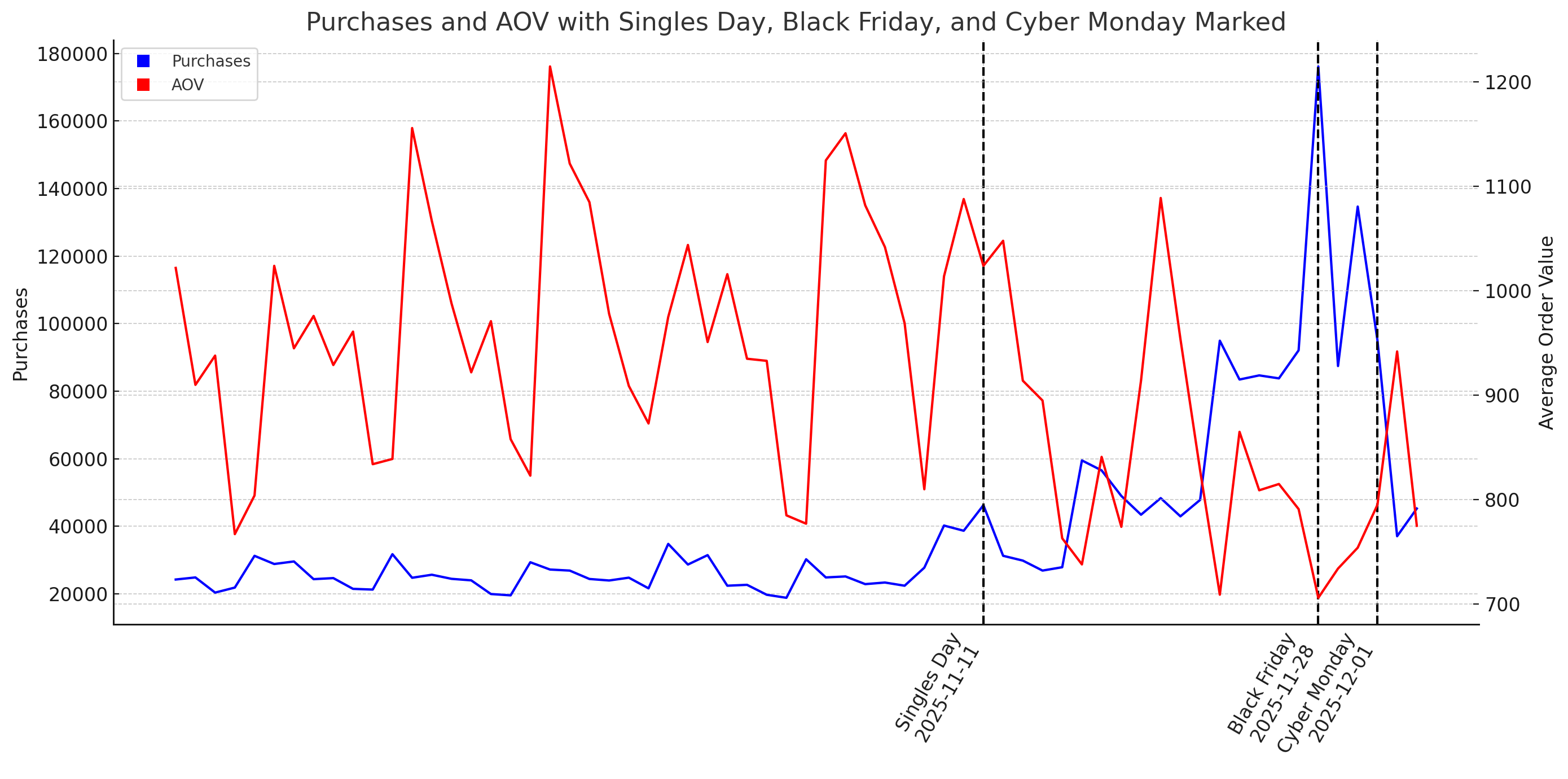

On Black Friday, customers made about five times more purchases than on a normal day, and total revenue was about 1.5 times higher. We also see a first peak around Singles Day, a short dip back to normal, and then a steep climb into Black Friday and the last day of Black Week.

- Singles Day saw an 84% increase in purchases with 46,249 orders.

- Black Friday saw a 600% increase in purchases with 176,120 orders.

- Black Friday also delivered a 250% increase in revenue, but average order value fell by 27% compared to October.

- Last day of Black Week saw a 434% increase in purchases with 134,643 orders.

- Cyber Monday (December 1) saw a 278% increase in purchases with 95,113 orders.

The last day of Black Week performs almost as well as Black Friday

The last day of Black Week catches two types of buyers:

- First, the people who waited too long on Black Friday and come back when they haven’t found a better deal.

- The last chance buyers who want one final look before sales end. This creates a second strong peak that almost mirrors Friday.

Traffic stats for Black Week 2025

Singles Day on November 11 marked the start of the shopping period. Traffic jumped 21% to 5.8 million visits (compared to a normal October Monday at 4.78 million).

Heart = Singles day. Black percentage icon = Black Friday. Robot = Cyber monday.

Instead of dropping back to baseline, visits stayed elevated and carried straight into the first day of Black Week on November 18, which landed at 5.3 million visits.

From there the buildup accelerated. Each day pulled in more traffic than a regular month, and the curve steepened as shoppers started taking action. The peak arrived on Black Friday where traffic jumped 81% to 8.67 million visits (compared to a normal October day).

Certain traffic sources spike intent but purchases land later

Early traffic from social, influencers, and discovery channels drives discovery during the whole november. Visitors arrive, browse around, and build their shortlist.

When the strongest offers drop, they return through direct, email, or branded search to complete the purchase. In this case, intent is likely correlated with the increased amount of pageviews.

The pattern is clear. People begin researching about a week before Black Week, peak heavily on Black Friday, and then drop back to normal once Cyber Monday passes.

Campaign behavior

We tracked about 2700 onsite campaigns during the period, with 165 of them built specifically for Black Week. Most pre-launch campaigns went live from November 1, which in turn also drove a lot of high-intent traffic once their offer dropped.

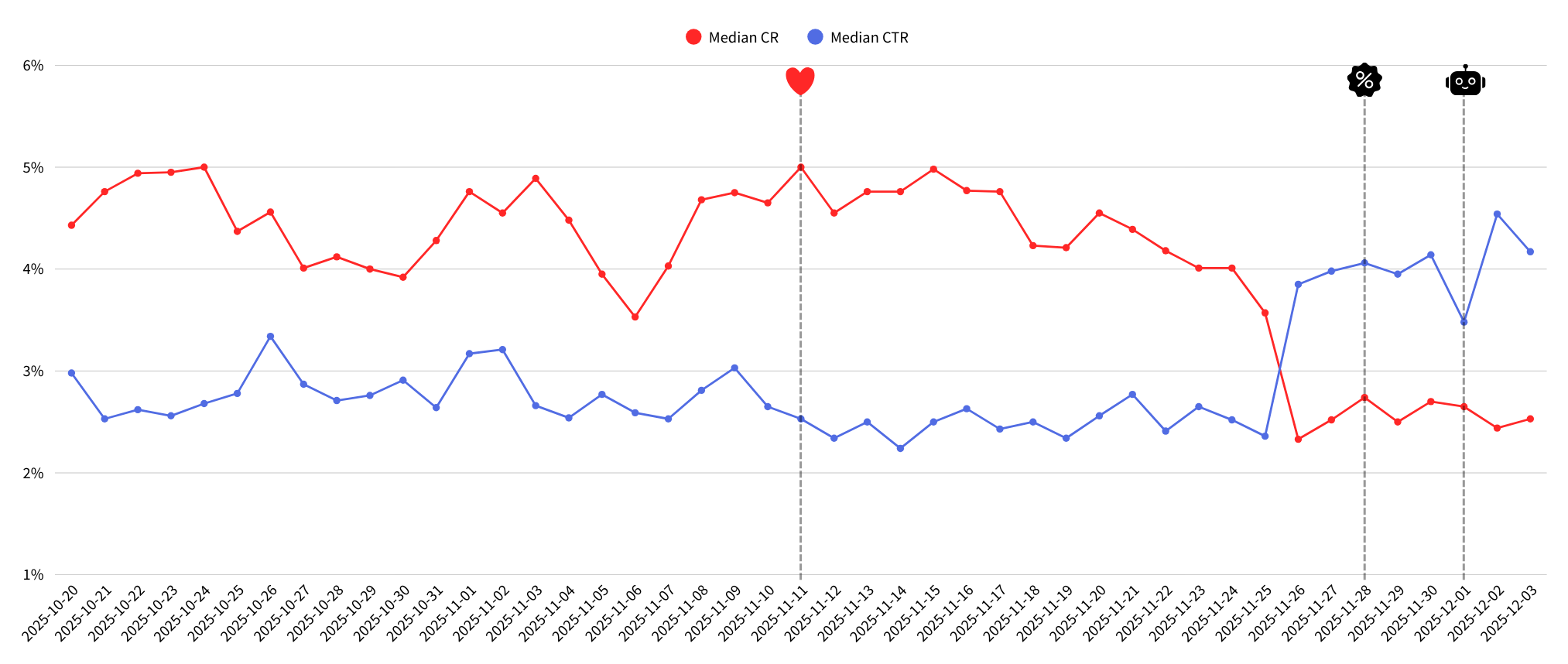

Decoupling CTR and Conversion rates in Onsite Campaigns

Before Black Week, CTR and CR moved together. But three days before Black Friday, CTR sharply increased and CR took a nosedive. This happens when visitors hunt for deals, compare options, and delay purchasing until discounts peak.

Heart = Singles day. Black percentage icon = Black Friday. Robot = Cyber monday.

Onsite Campaigns that outperformed before Black Week

These campaigns connect directly to the first and fourth drivers: early research and CRM preparation.

Pre access campaigns

Conversion rate: 16%+ (150% higher CR than normal)

These campaigns invite visitors to sign up for early access to Black Week/Friday deals. They usually launch about two weeks before Black Friday.

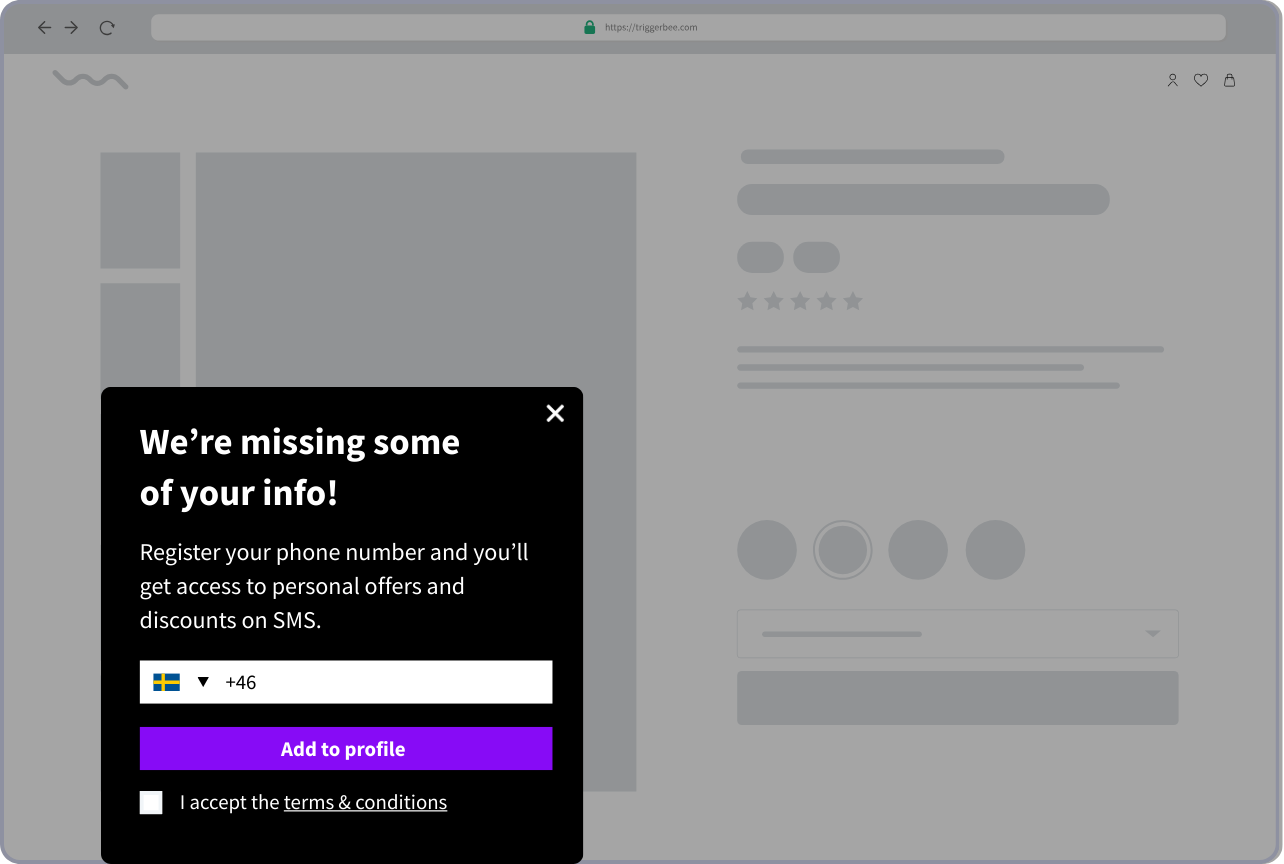

CRM enrichment campaigns

Conversion rate: 100% higher CR than normal

Brands use enrichment campaigns to gather consents and update subscriber data leading up to Black Week/Friday. During November these campaigns convert at roughly twice their October levels, which goes to show that people prepare for the sale period and are more open to sharing data.

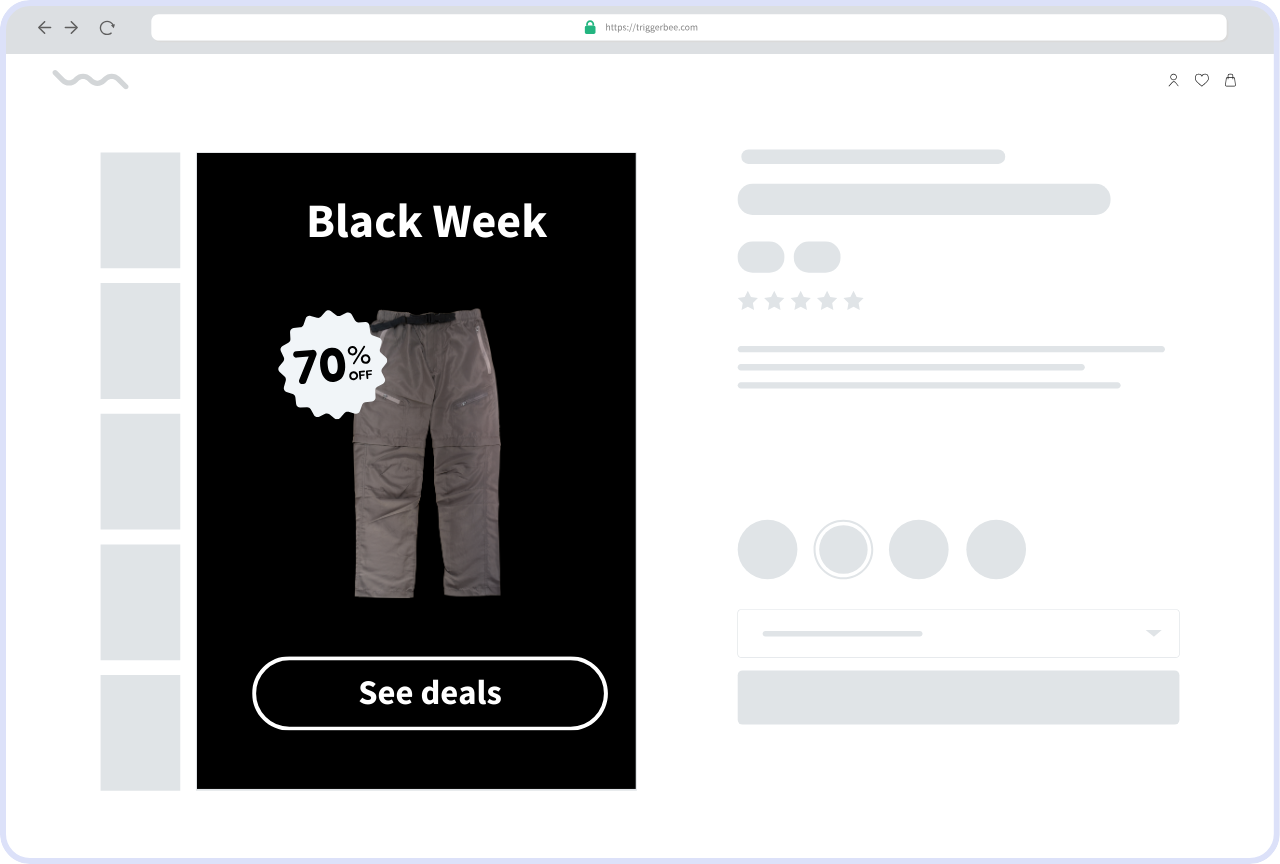

Onsite Campaigns that outperformed during Black Week

Once Black Week starts, the focus shifts from signup to deal visibility. Visitors expect to see the deal right away on category pages, product pages, and the homepage.

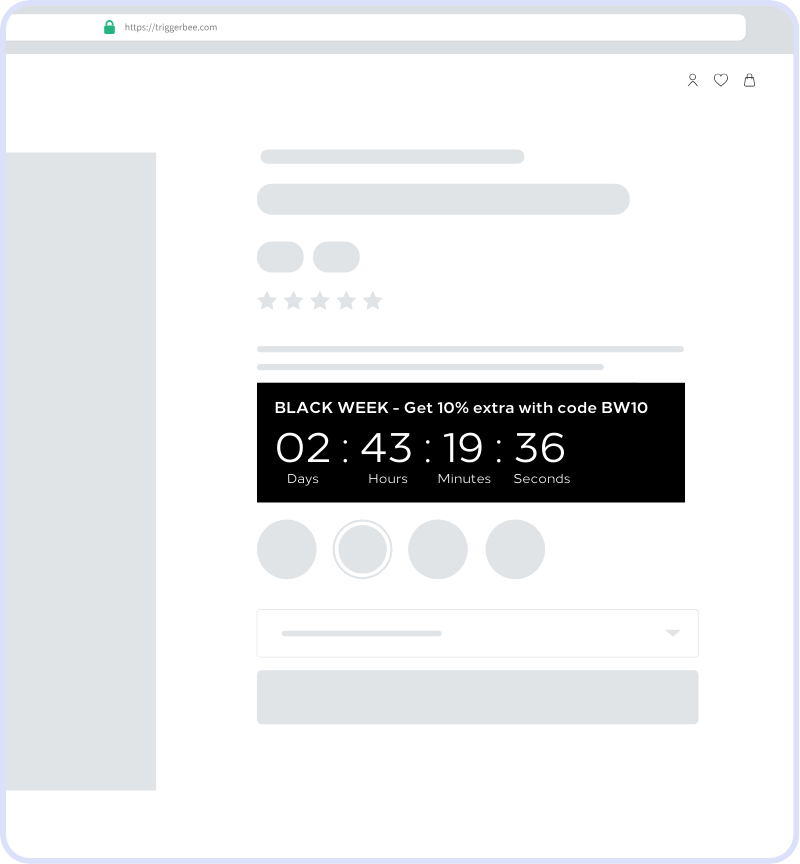

Deadline campaigns

The use of countdowns and deadlines saw a 100%+ increase, which is not that surprising. These campaigns work best two to three days before Black Friday and during the day itself.

The use of countdowns and deadlines saw a 100%+ increase, which is not that surprising. These campaigns work best two to three days before Black Friday and during the day itself.

Promotional / Deal highlight campaigns

What this means for marketers going into Black Week 2026

Black Week is not about one day. It is a long window of research, warm up, and timing.

The brands that performed best did three things well:

- They captured demand early

- They enriched and cleaned CRM data before the peak

- They switched to clear, deadline driven offers during the final days

The four drivers behind this year’s performance

Visitor behavior follows the same overall shape each year, but this time the data gives us much clearer proof of why.

1. Early research builds demand long before the buying peak

Singles Day was the trigger of this year’s holiday season. Visits grew from 4.7M on Nov 8 to 5.8M on Nov 11, and Pageviews per visit climbed 25%. The number of purchases went up ~84%, but the average order value was only 8% higher compared to October.

2. Offers matter more than timing

By the time Black Week officially started, shoppers already knew what they wanted. The real lift came from the strength of the offers, not from the date. This explains why purchases jumped from 46K on Singles Day to 176K on Black Friday without a similar rise in traffic.

3. Deadline messaging works best during the peak

The final 72 hours before Black Friday drove the steepest purchase lift, with conversion climbing from 1.26% on Nov 27 to 2.03% on Nov 28. Countdown campaigns doubled in usage and matched this pattern.

4. CRM preparation pays off

Brands that collected data early saw better results later. CRM enrichment campaigns converted about 100% higher compared to in October, and pre-access campaigns hit an average 16% conversion rate, roughly 150% higher than normal.

How to act on these four patterns in 2026

- Early research builds demand

Start two to three weeks before Black Week with light discovery campaigns. Use pre access forms, interest surveys, and personal landing pages to catch visitors while they browse. - Offers matter more than timing

Make the value obvious. Use simple offer framing, strong visual hierarchy, and avoid too many variations. People already know what they want. Give them a reason to act. - Deadline messaging wins during the peak

Use countdowns, “ends tonight”, and limited stock messaging in the last 72 hours. These elements push already decided shoppers over the edge. - CRM preparation pays off

Focus on high quality opt-ins in October and early November. Better data means stronger performance once the sale begins.